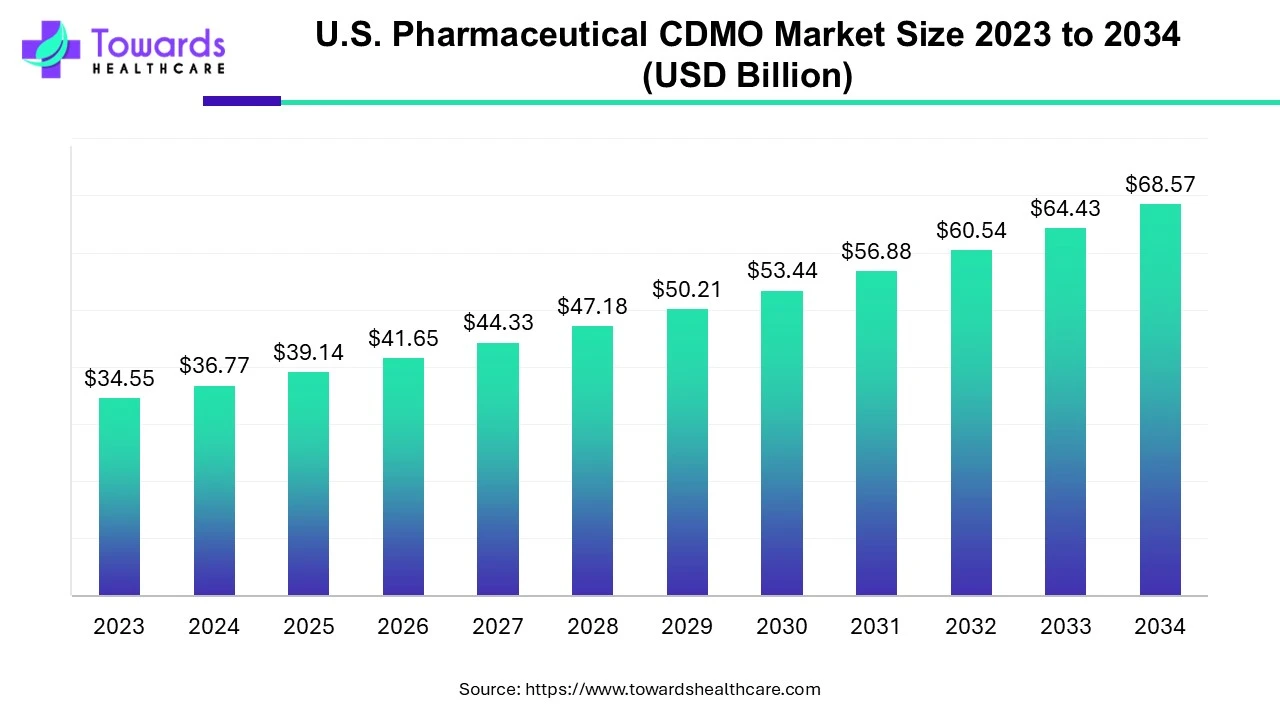

U.S. Pharmaceutical CDMO Market Valuation to Surpass USD 68.57 Billion by 2034

The U.S. pharmaceutical CDMO market is estimated at USD 39.14 billion in 2025 and is projected to reach approximately USD 68.57 billion by 2034, expanding at a CAGR of 6.43% over the forecast period.

Ottawa, Aug. 13, 2025 (GLOBE NEWSWIRE) -- According to a study by Towards Healthcare, a sister firm of Precedence Research, the U.S. pharmaceutical CDMO market was valued at USD 36.77 billion in 2024 and is projected to reach approximately USD 68.57 billion by 2034, growing at a CAGR of 6.43%.

The rising commercial scale-up in different therapeutic areas in the US and growing adoption of digital technologies are fueling overall market expansion.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5407

Key Takeaways

- By product, the API segment dominated the U.S. pharmaceutical CDMO market in 2024 and is expected to grow fastest during the forecast period.

- By workflow, the commercial segment held the largest revenue share of the market in 2024.

- By application, the oncology segment registered dominance in the market in 2024.

- By end-use, the large pharmaceutical companies segment was dominant in the U.S. pharmaceutical CDMO market in 2024 and is expected to grow rapidly in the studies years.

Market Overview & Potential

Companies that are offering comprehensive services to different pharmaceutical and biotechnology companies, including both drug development and manufacturing in the US, are referred to as U.S. pharmaceutical CDMO market. Primarily, they provide expertise and resources for these companies.

In 2025, they are focusing on novel drug discovery and development in oncology and other chronic conditions with the increased adoption of advanced production technologies. Moreover, the US is widely investing in robust and advanced infrastructure to fulfil the requirements of the increasing demand for specialized services, particularly in areas like biologics, sterile injectables, and gene and cell therapies.

What are the Key Drivers Involved in The Growth of The Market?

The U.S. pharmaceutical CDMO market has major dominating factors in its expansion, including crucial support to small and mid-sized pharmaceutical companies. These companies are facing the limitations of infrastructure for large-scale production with enhanced dependence on CDMOs for numerous stages of development and manufacturing.

Also, benefits of pharmaceutical CDMOs, like scalability, flexibility, and cost-effectiveness, are fueling the expansion of the market with reduced capital investments. Besides this, experts working in CDMOs can navigate the complex regulatory landscape and check the compliance with standards like GMP (Good Manufacturing Practices).

What are the Trends Associated with the U.S. Pharmaceutical CDMO Market?

Different companies in the US are highly adopting outsourcing production to CDMOs to handle expenses and emphasis on competencies. Alongside, continuous advances in technologies and regulatory frameworks also play a crucial role in this market development.

- In May 2025, CDMO Piramal Pharma Solutions announced $90 million investment into its US manufacturing facilities.

- In March 2025, LGM Pharma, a global provider of customized API and CDMO services for the full drug product lifecycle, invested $6M in U.S. drug manufacturing capabilities for liquids, suspensions, semi-solids, and suppositories.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Is the Emerging Challenge in the Market?

Challenges connected with the U.S. pharmaceutical CDMO market include geopolitical stress, lack of raw material, and pandemic-related disturbances, are contribute as barriers in the production and delivery. Along with this, the rising need for a skilled workforce and specialized knowledge in continuous manufacturing and advanced bioprocessing demands vital investment in training and development.

Country-level Analysis

The U.S. pharmaceutical CDMO market is experiencing widespread expansion due to broader demand for a variety of biologics and biosimilars which are used in novel rare cases and other severe health issues. Besides this, ongoing technological breakthroughs in process chemistry and manufacturing automation are boosting the efficiency and quality of drug production, further propelling the adoption of CDMO services. As well as escalating cases of diverse cancers is assisting the development of novel cancer therapies, including targeted therapies and immunotherapies.

For this market,

- In June 2025, Agenus Inc., a U.S.-based biotechnology company specializing in immuno-oncology, entered into a partnership with $141M Zydus investment to transform the immune-oncology area.

Segmental Insights

By product analysis

How did the API Segment Lead the U.S. Pharmaceutical CDMO Market in 2024?

The API segment was dominant in the market in 2024 and will grow rapidly during 2025-2034. An escalating demand for both traditional and complex APIs, especially in small molecule drugs, is fueling the segment's growth. In this segment, synthetic APIs experienced major demand, which are highly employed in numerous therapeutic areas such as cardiovascular, analgesic, and CNS drugs, making them an important driver in the API CDMO market.

Also, this segment is moving towards continuous manufacturing, process analytical technology (PAT), sustainability, and digitalization, with enhanced focus on specialized CDMOs catering to niche therapeutic areas and expansion in biotech API development.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

By workflow analysis

What Made the Commercial Segment Dominant in the Market in 2024?

In the U.S. pharmaceutical CDMO market, the commercial segment captured a major revenue share in 2024. Across the globe, one of the vital factors contributing to the overall market expansion is improved focus on the large-scale manufacturing of pharmaceuticals and biopharmaceuticals for commercial distribution. Moreover, widespread involvement of specialized expertise in biologics, cell & gene therapies, and mRNA vaccines necessitates sophisticated and specialized manufacturing capabilities. Additionally, CDMOs are boosting their service offerings by expanding collaboration with other organizations and companies to incorporate the complete drug development and manufacturing lifecycle, from early development to commercial launch.

By application analysis

How did Oncology Dominate the U.S. Pharmaceutical CDMO Market in 2024?

The oncology segment registered dominance with the biggest share of the market in 2024. Eventual growth in cancer cases, with the progression of personalized therapies and targeted treatments, is impacting segment expansion. US CDMOs are stepping towards the transformation of advanced therapies, especially cell and gene therapies, antibody-drug conjugates, and bispecific antibodies, which are a major part of oncology clinical trials. These therapies are widely propelling demand for specialized facilities and expertise in handling potent APIs, cytotoxic compounds, and sterile injectables.

By end-use analysis

How did the Large Pharmaceutical Companies Hold a Major Share of The Market in 2024?

The large pharmaceutical companies segment led the U.S. pharmaceutical CDMO market in 2024 and is anticipated to witness the fastest growth during 2025-2034. Nowadays, a rise in innovation investments, mainly in data analytics and AI, is assisting overall drug development processes and ultimately enhancing productivity.

Apart from this, these companies are focusing on the utilization of advanced formulation technologies in specific areas, especially oral peptide formulations and permeation enhancers, to optimize drug delivery. These companies frequently grasp their robust infrastructure, scientific expertise, and global networks, which make them attractive for further collaborations and outsourcing to CDMOs in the US.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Ongoing Developments in the U.S. Pharmaceutical CDMO Market

- In July 2025, ESTEVE acquired Regis Technologies, a United States-based Contract Development and Manufacturing Organization (CDMO), to accelerate its contract development and manufacturing services for small-molecule active pharmaceutical ingredients from pre-clinical to commercial manufacturing in the US.

- In May 2025, Purdue University and a collaboration of leaders in AI, pharmaceutical manufacturing, and public policy launched a national effort in the Dirksen Senate Office Building to boost pharmaceutical manufacturing in the United States by revealing cutting-edge AI and advanced manufacturing technologies.

- In May 2025, Benuvia Operations, LLC, a U.S.-based global Contract Development and Manufacturing Organization (CDMO) and Active Pharmaceutical Ingredient (API) supplier, signed a multi-year supply agreement with a prominent U.S. pharmaceutical company to support the company's product development activities.

Key Players in the U.S. Pharmaceutical CDMO Market

- Adare Pharma Solutions

- AGC Biologics

- Agilent Technologies

- Catalent Pharma Solutions

- Exela Pharma Sciences

- PCI Pharma Services

- Pfizer CentreOne

- Scorpius BioManufacturing

- Sharp Services

- Single Use Support

- Thermo Fisher Scientific

- UPM Pharmaceuticals, Inc.

Browse More Insights of Towards Healthcare:

The global bioconjugation market reached USD 5.52 billion in 2024, rose to USD 6.37 billion in 2025, and will likely hit USD 23.18 billion by 2034, expanding at a CAGR of 15.46% from 2025 to 2034.

The U.S. residual DNA testing market continues its upward trajectory and is set to generate substantial revenue growth, potentially reaching hundreds of millions by 2034.

The worldwide life science CDMO market is expanding significantly and is projected to record several hundred million dollars in additional revenue by the end of the forecast period from 2025 to 2034.

The global veterinary CRO and CDMO market stood at USD 7.17 billion in 2024, increased to USD 7.77 billion in 2025, and will likely reach USD 16.13 billion by 2034, growing at a CAGR of 8.43% between 2025 and 2034.

The global investigational new drug CDMO market measured USD 5.29 billion in 2024, rose to USD 5.66 billion in 2025, and is forecast to reach USD 10.34 billion by 2034, expanding at a CAGR of 6.97% during the same period.

The global advanced therapy medicinal products CDMO market stood at USD 6.73 billion in 2024, grew to USD 7.99 billion in 2025, and will likely surge to USD 37.27 billion by 2034, posting a CAGR of 18.82% between 2025 and 2034.

The global mRNA therapeutics CDMO market valued at USD 4.62 billion in 2024, increased to USD 5.15 billion in 2025, and is projected to reach USD 13.63 billion by 2034, growing at a CAGR of 11.37% from 2025 to 2034.

The CDMO services for pharma and biotech market is posting substantial growth from 2024 to 2034, fueled by rising outsourcing trends among pharmaceutical and biotech companies.

The CDMO aseptic filling solutions market is recording robust growth and will continue booming through the forecast period, driven by growing demand for sterile manufacturing and specialized injectable therapies.

The active pharmaceutical ingredients CDMO market stood at USD 127.45 billion in 2024, rose to USD 136.92 billion in 2025, and is projected to reach USD 260.98 billion by 2034, expanding at a CAGR of 7.43% from 2025 to 2034.

Segments Covered in The Report

By Product

- API

- Type

- Traditional API

- Highly Potent API

- Antibody-drug conjugate (ADC)

- Others

- Synthesis

- Synthetic

- Solid

- Liquid

- Biotech

- Synthetic

- Drug

- Innovative

- Generics

- Manufacturing

- Continuous Manufacturing

- Batch Manufacturing

- Type

- Drug Product

- Oral Solid Dose

- Semi-Solid Dose

- Liquid Dose

- Others

By Workflow

- Commercial

- Clinical

By Application

- Oncology

- Small Molecules

- Biologics

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disease

- Metabolic Disorders

- Autoimmune Diseases

- Respiratory Diseases

- Ophthalmology

- Gastrointestinal Disorders

- Hormonal Disorders

- Hematological Disorders

- Others

By End-Use

- Large Pharmaceutical Companies

- Medium Pharmaceutical Companies

- Small Pharmaceutical Companies

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5407

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region - +44 778 256 0738

North America Region - +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.